Spending In Retirement

Spending in Retirement

As many of our clients are retired or nearing retirement, we at Eclectic Associates pay special attention to research in that area. A recent study by J.P. Morgan about spending was particularly interesting, and we thought it could be applicable to our clients as they consider their own retirement.

According to the study, five “Profiles” emerged to broadly represent the modern retiree:

Foodies: Foodies make up 39% of retirees. These people spend more of their money on food and drink, including eating out, and on goods from “big box” stores.

Homebodies: Homebodies make up 29% of retirees as they invest in paying off mortgages, making home improvements, purchasing second/vacation homes, etc.

Globetrotters: Globetrotters only make up 5% of retirees, according to the study. These are the retirees who choose to spend the bulk of their savings on travel.

Health Care Spenders: Health care spenders make up 4% of the retirees, who have to pour more of their money into health care than anything else.

Snowflakes: The remaining 24% do not cleanly fit into one of the above categories, so the study termed them as snowflakes. These retirees may find commonalities with multiple categories or none at all.

Even if a retiree is not in the Health Care Spender category, health care is obviously a factor that will impact all retirees at some point. However, the study concluded that most retirees have similar spending patterns on health care – with the exception of the Health Care Spenders – as shown below:

Annual Median Spending age 65-74 (% spent on Health Care):

Foodies: 6%

Homebodies: 3%

Globetrotters: 5%

Health Care Spenders: 28%

So then, according to the study most retirees will spend a relatively low percentage of their income on health care, even as those costs are expected to continue to rise (over the period from 1982-2014, the average inflation rate of health care was about 5%).

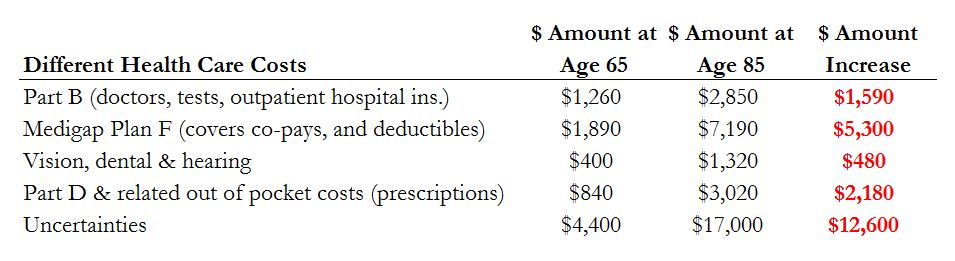

The study makes it clear that a large part of the increase in costs will come from Medicare, especially as retirees age and require more medical services. The chart below from the study shows the average difference in spending for two age groups.

Median Costs:

As you think about where you fit into this study, here are some questions that may help give insight into your profile as a retiree. With these questions in mind, you can consider your current lifestyle and what you see your retired lifestyle looking like in the future.

- How much do you spend on housing?

- Will that be increasing or decreasing?

- How often do you travel/ do you plan to travel?

- How much do you enjoy fine food and drink?

- How is your health? Excellent, good, fair, poor?

- How much are your health care expenses now?

- Do you see these expenses increasing in the future enough to need what J.P. Morgan refers to as a “cushion”, or an additional amount of savings?

At Eclectic Associates, we feel that it is important for us to understand your goals and what spending in retirement will look like for you. We want to be aware of trends such as rising health care costs, and help you be realistic about what you may need in your retired years.